*Article #78805 (79187 is last):

*From: eflahert@garnet1.acns.fsu.edu (Edward

Flaherty)

*Newsgroups: sci.econ

*Subject: Antidote to the "Debt Virus"

*Date: Tue Oct 14 15:58:26 1997

*DEBT VIRUS HYPOTHESIS:

* The central

thesis of Debt Virus is that there exists in the

*economy an insufficient quantity of money

to repay both the

*principal and the interest on all the

currently outstanding debt.

*The problem is when banks lend money,

only the principal is created

*and never the interest. Thus, the money

supply can never be

*sufficient for total debt retirement.

JCT: Connecting

debt to the price structure, say 10 businesses in

the village all borrow Principal = $1

million at 10% for a year and

spend the million that year producing

their goods for sale. At the end

of the year, assuming zero profit, what

is the minimum price for their

goods? Principal + Interest or the debt

cannot be paid.

So prices on

the store shelves=P+I and money in circulation=P.

* Fortunately

for us, Jaikaran's model contains two gaping holes

*which collapse his entire thesis.

* Banks are no

different in the real world. Commercial banks

*and savings and loans have expenses to

pay just like any other

*firm. They must pay their employees,

purchase office supplies, and

*meet the other expenditures which are

a part of doing business.

*When they do this banks spend money ��back

into the economy without

*any debt being created to burden the

non-bank public -- debt-free

*money as it were. The revenues banks

collect from interest on

*loans and other services do not disappear

into an economic void.

*Instead, those revenues are used to meet

the bank's operating

*expenses, to purchase assets to generate

future income, or are paid

*to the shareholders as dividends.

JCT: "Spend money

back" implies funds they were first taken into

the reservoir. So revenues from interest

in the reservoir are used to

meet the bank's expenses, to purchase

assets or are paid as dividends

which come out of the reservoir. That

fits in with my plumbing model

of the banking system in my Engineering

Analysis:

Fig. 3

FRACTIONAL RESERVE BANK

Fig. 3 is the

interior plumbing of a chartered bank which shows

that the revenues banks collect through

the Interest(in) pipe from

loans and other services are used to meet

the bank's operating

expenses, to purchase assets to generate

future income, or are paid

to the shareholders as dividends through

the Bank Expenses pipe. And

it is true that these funds go back to

the economy free of debt though

I call it splashing in the pool.

Then he states:

*In the real world banks must pay their

employees, pay interest

*to their depositors, meet their other

expenses, and purchase

*equipment. When the banking system does

this, it spends into

*existence new "debt-free" money (debt-free

in the sense that no one

*outside the banking system is required

to obtain a new loan). In

*other words, the system creates

a new demand deposit out of nothing,

*adding to the money

supply without the creation of any additional

*bank credit (loans plus bank-held bonds)

being necessary.

JCT: This says

that the Bank Expenses tube is connected to a tap

which is adding the the money supply.

Fig 3b

FRACTIONAL RESERVE BANK

*Summarizing the first counterpoint, the

banking system creates new

*"debt-free" money in the form of new

deposits whenever it pays its

*expenses or purchases fixed assets. These

deposits do not represent

*loan principal or interest which the

non-bank public must eventually

*repay. Contrary to the Debt Virus thesis,

new bank credit is not the

*only source of new money.

JCT: The banking

system does not create new "debt-free" money in

the form of new deposits whenever it pays

its expenses or purchases

fixed assets. It uses debt-free revenues,

old deposits, whenever it

pays its expenses.

* The other major

flaw in the Debt Virus hypothesis is that it

*ignores the role of the central bank

in the money-creating process.

*The Federal Reserve creates a measure

of debt-free money when it

*buys government bonds from the public.

The Fed buys the bonds on

*the open market and pays for them by

creating new checkbook money.

*The new money is therefore created without

any additional debt

*appearing in the economy.

JCT: Say there's

a billion in the US citizen hands and they buy

the government's billion dollar bond.

When the Fed buys that bond from

citizens, they inject a new billion and

take the bond. The government

still has their billion, the people now

have their billion and the

government now owes the FED instead of

the people.

Same process

if the government lets the citizens keep their

billion and simply borrows the new billion

from the FED. The

government would get their billion, the

people would keep their

billion and the government would owe the

FED the billion.

Yet, buying government

paper is the same process as buying a

borrower's paper during a loan. Either

way, the borrower has a deposit

put in his account in exchange for signature

on the loan document

whether called a mortgage or a bond.

So the point

of the Debt Virus still applies to the FED's

purchases of government bonds. If the

Debt Virus infects interest-

bearing loans, does it similarly infect

interest-bearing bonds? Yes.

*Jaikaran's central thesis that new money

is created only through new

*bank lending is thus countered by the

facts that banks create

*debt-free money when they pay their operating

expenses, purchase

*assets, and disburse dividends, and that

the Fed creates debt-free

*money in the process of buying government

bonds.

JCT: They don't

create debt-free money, they spend revenues debt-

free which makes a big difference.

So that's all

there is to his objections to the Debt Virus. It's

interesting though. Old Socreds use the

debt virus to argue that the

price of debt is always higher than the

money we got and suggest ways

of injecting new money to balance the

equation and Ed counters that

debt free money is already being issued

to balance the equation.

Having with his

own words disproved the two sources of funds he

alleged were coming out of the pumphouse,

we are back to the original

Debt Virus theory which stands unchallenged.

And even if bank's

expenses were coming from the tap, nowhere

does he say if enough money

is being issued to balance the equation.

He does point out that there

is enough money residing in the US to

pay off the debt but the debt

virus deals with world debt and the fact

that more rich people choose

to save their dollars in the States than

Biafra has no bearing on the

automatic shortage created everywhere.

How about the global figures?

That's it for his antidote

to the debt virus.

To counter the

need to inject such new money to solve the debt

virus, Flaherty now says that it's already

being done, that the banker

is injecting money from the pump without

adding it to the loans due.

Even if true, are the bankers spending

enough from the pump to cure

the balance or are some of the symptoms

predicted by the debt virus

hypothesis not proven out. If they are

injecting half enough, are we

seeing half the effects predicted by the

debt virus hypothesis?

But he forgets

that the money paid in interest and expenses and

all these things have first been taken

in in interest and service

charges in the first place.

So he tries to

say that the problems raised by the imbalance are

already solved by the bankers in the Social

Credit suggested way of

adding new money from the pump to the

economy to balance the debt. The

fact Ed's splashing in the pool, injecting

money "back" in that has

been previously taken out, validates the

debt virus hypothesis. The

fact Ed sought a solution in the pump

house indicates that that's

where the fundamental problem and misunderstanding

is.

* The idea is

also objectionable for other less direct reasons.

*Jaikaran's main warning is that if we

wished to repay all the debt,

*we would be unable to do so because of

the shortage of money. But

*why would we wish to retire all the outstanding

debt in the

*economy?

*most debt in the U.S. economy is in the

form of bonds, not bank

loans.

*This is important for his thesis because

unlike the lending process,

*the issuing of new bonds and the retiring

of old ones does not affect

*the money supply. Therefore, a

given money supply can repay a total

*bond debt many times its size, in fact,

a debt infinitely greater

*than the money supply.

JCT: Find A who

owes B who owes C who owes A and splashing a $50

bill around in the pool can settle many

bonds. But not bonds bought by

banks in the creationary process whose

payment results in the

destruction process.

* The f

He proposes having

*the federal government print currency

to finance its entire budget,

*thereby eliminated its need to tax or

to borrow.

JCT: Using LETS,

government would still need to tax but not to

borrow. This "not to tax" stuff is the

old Social Credit theory which

certainly would have eliminated the need

to borrow. Not having to

service government debt would certainly

reduce its need to tax but

paying for public utilities, services

and projects may still need to

be financed by taxation. Which is how

a government LETS would work.

Government would spend all the Green necessary

for the upkeep of the

realm and tax that amount out of circulation

pursuant to standard LETS

accounting rules.

*This would create an infusion of debt-free

money which would make

*it possible for the economy to repay

all its debts.

JCT: This would

certainly soak up all of the government money in

an acceptable way for the first few years.

People would be earning

good salaries and paying down their interest-bearing

debts. But

redemption would eventually be necessary

and should be done by

taxation. I still argue giving each person

their own interest-free

Green account and simply letting everyone

convert their interest-

bearing debt to interest-free debt by

writing checks to their

creditors is the quickest and easiest

way. Governments can do it too.

*Since he argues that inflation is really

caused by interest on debt,

*this would have the added benefit of

generating price stability.

*Unemployment, crime, marital difficulties,

and war are each merely

*symptoms of our debt-money system and

can be cured by something so

*simple as a switch to a debt-free money

supply.

JCT: Yes. Deliverance

from a debt-growth-free money system is

financial utopia but it's simply good

financial engineering.

I hate the use

of the words "debt-free" by the old Social

Crediters. They say that the problem is

debt money. Money created as a

debt.

A debt-based

currency is just as good as a wealth-based currency.

A casino check can be a wealth-based currency,

a warehouse receipt for

collateral in the cage or it can be a

debt-based currency, tokens

issued for a player's IOU debt.

Assume that most

of Sears' 60 million account holders owe $1000

on average. Should Sears offer members

to option to transfer between

each others accounts using LETS checks,

transactions made with that

debt-money are as valid as transactions

made with federal currency

accounts.

So whether the

currency is a wealth-based currency or a debt-

based currency is irrelevant and switching

between the two is not the

solution. It's the interest on the debt

that is the real culprit of

what they call the "debt-money" system.

Replacing the words "debt-

money" for "usury-money" would leaves

me no arguments with the debt

virus hypothesis.

As I've explained

in my Social Credit Posts, Douglas Social

Credit is very similar to Turmel Social

Credit.

Douglas Social

Credit [A/(A+B)] argues that money issued into

circulation is A and the prices are inflated

to A+B where B includes

not only the Interest but also other expenses

which I have found to be

non-consequential such as rent, taxes,

overhead.

Turmel Social

Credit [P/(P+I)] argues that everyone borrows the

money principal P into circulation and

everyone must inflate their

prices to pay their debt of P+I with interest

being the only true

cause of the shortage of money to buy

the goods.

Douglas

Social Credit chooses to solve the imbalance between

purchasing power A and prices A+B by adding

to the numerator by

government spending money "debt-free"

on operations, public works,

compensated business discounts and dividends

right to the citizens.

This is the only time the use of the term

"debt-free" applies because

government would be spending it without

needing to tax it back.

Turmel LETS Social

Credit chooses to solve the imbalance between

the P and prices P+I by eliminating the

I from the denominator and

eliminating the imbalance in the first

place. In a LETS, the

government could not just print and spend

to balance the debt because

prices will have been already stabilized

to the debts. Government will

simply have to be another financial participant

borrowing all the

Green funds necessary for the upkeep of

the realm and taxing it back

pursuant to sound casino accounting principles.

Douglas The Engineer

accepted as inevitable a Money-Prices

imbalance and came up with a slew of currency

injection devices to

compensate for it while Turmel The Engineer

does not accept the

imbalance as inevitable. Sure, we could

go to the old Social Credit

way but it needs software to treat government

differently while the

new social credit way uses the same software

for all accounts.

*In short, Jaikaran promises the reader

*an economic paradise if only the government

would end taxation,

*cease borrowing, and instead print money

to pay its bills.

JCT: And Turmel

promises the reader an economic paradise if only

the government would cease borrowing and

match the taxation to the

money it had printed to pay its bills.

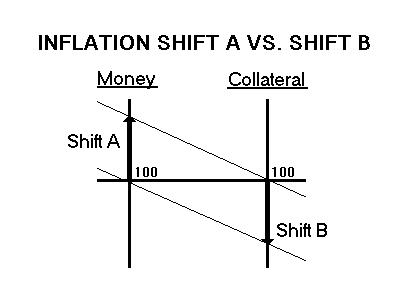

INFLATION SHIFT A:

* Any economist

in the world would recognize this idea as a plan

*for economic chaos. One of the best demonstrated

theories in this

*social science is that an excessive growth

of the money supply

*always causes inflation.

JCT: It might

be recognized this way by anyone who believes that

inflation is Shift A but not by anyone

who believes that inflation is

Shift B.

HOW "MORT-GAGE" INTEREST CREATES A DEATH-GAMBLE

The word "mort-gage"

is derived from the French word "mort"

meaning "death" and "gage" meaning "gamble".

Bankers create the money

supply when they make loans. Producers

are forced to gamble by

borrowing newly created Principal(P) to

pay for production costs and

then inflating their prices to recuperate

the Principal and

Interest(P+I) in sales. Because total

goods priced at (P+I) can never

be sold when consumers only have P dollars

available, a minimum amount

of goods must remain unsold and a minimum

number of producers must

fail and suffer foreclosure. The economist

Keynes likened the mort-

gage death-gamble to the game of musical

chairs. Just as there are

insufficient chairs for all to survive

the musical chairs death-

gamble, so too, there is insufficient

money for all to repay (P+I) and

survive the mort-gage death-gamble.

P < principle, I < Interest, i <

Interest Rate, t < Time

| PERCENT | ALGEBRA | EXP. FUNC | |

| Production costs (principal) | 100 | P | 1 |

| Production prices (Debt) | 100+1 | P+l | exp(it) |

| Purchasable Value | 100 | P | 1 |

| or ratio of money to prices | ----- | ----- | ----- |

| or survivors | 100+i | P+l | exp(it) |

| Unpurchasable value | i | l | 1 |

| or forced unemploymen | U= ----- | ----- | 1 - ----- |

| or non-survivors | 100+1 | P+l | exp(it) |

| For U=0, let | i=0 | l=0 | i=0 or t=0 |

Fig. 4

Dollars Assets

Most people who

have not studied economics, if asked whether

interest fights or causes inflation, are

quick to agree that a

merchant must pass on increased interest

costs in his prices and

therefore it is evident that increased

interest costs will result in

increased prices.

*The federal government's expenditures

totalled $1,560.1 billion in

*fiscal year 1996. If it were to print

and spend all the money for

*similar budgets rather than raise it

through taxes, then the M1

*money supply would more than double in

a year. The annual inflation

*rate would hit 100 percent within two

years.

JCT: Not true.

First of all, he assumes the money supply just

doubles in one year without a corresponding

increase in value to back

it up. Yet, he notes in the Sovereignty

Proposal:

*2. Spend the New Money on Capital Projects

*Sovereignty specifically proposes that

about $360 billion of

*this new money be printed and spent by

the Treasury on

*various capital projects by the federal

government, or loaned

*interest-free to local governments for

their own projects or

*debt retirement. This would improve the

production capacity of the

*economy, reduce the Treasury's annual

interest costs, reduce the debt

*burden of state and local governments,

and most importantly help to

*relieve the money shortage.

JCT: Yes on all

counts. Key point. Loaned interest-free. They

must pay it back. And the funds the municipalities

receive are spent

in the creation of new capital projects

so that injection of funds

into the US economy would have a zero

component of inflation. It would

actually reduce inflation.

In the most recent large-scale example

of government use of a LETS local currency,

large injections of local

currency caused overall federal inflation

to drop substantially.

Again, let me repeat this very important

point.

It is true that

while suffering inflationary Shift A, an increase

in the money supply would increase inflation,

but while suffering

inflationary Shift B, an increase in the

money supply will reduce

inflation!

The most recent

large-scale use of a LETS 1/s local currencies

was by 6 Argentinian provinces. In Tom

Greco's book of LETS resources:

New Money for Healthy Communities ISBN

0-9625208-2-9" page 73, is an

article that showed that small denomination

government bonds were

being tried and had shown startling results:

Thursday November 28, 1985,

The Charlotte Observer,

CASH-STARVED ARGENTINE PROVINCES TURNING

OUT THEIR OWN MONEY

By Andres Oppenheimer, Knight-Ridder News.

MIAMI -- Two

remote Argentine provinces, short of cash to pay

public employees, have come up with an

easy solution.

They're printing

up their own money, to the chagrin of the

national and international banking authorities.

"We are paying

all our public employees with provincial bonds,"

Roberto Romero, governor of the northern

Argentina province of Salta,

said in a telephone interview. He said

Salta started printing its own

IOUs because it wasn't getting sufficient

federal currency fast

enough.

"People can change

these bonds for money at any bank," Romero

said. "They can use them to shop at supermarkets

and to buy cars or

any other products."

The Argentine

government is not smiling, and world bankers are

worried that other cash-starved states

will copy Salta's financial

extravaganza and jeopardize Latin efforts

to curb inflation and pay

huge foreign debts.

The International

Monetary Fund (IMF), the world's main financial

inspector for debt-ridden countries, was

concerned enough to bring up

the issue in recent talks with the Argentine

government, said sources

in Argentina and Washington. The IMF does

not comment on negotiations

with individual countries.

After Salta started

quietly issuing its own IOUs in September

last year, the nearby province of La Rioja

started printing its own

bonds too. Four other Argentine provinces

have either begun adopting

similar programs or are preparing to do

so.

In all cases,

the bonds are good only within the province where

they're issued.

But the government

of President Raul Alfonsin says the provincial

bonds are expanding the country's money

supply and are undermining

efforts to remove Argentina from the list

of world inflation leaders.

Earlier this year, Argentina had a 1,000%

annual inflation rate.

Alfonsin made

headlines worldwide in June when he launched an

austerity program built around a commitment

to stop his government

from printing money. Since then, inflation

has dropped to 3% a month,

a record low in recent history.

The bonds printed

in Salta come in denominations of 10, 100, and

1,000 australes, the same as ordinary

Argentine currency bills. They

pay no interest and can be either exchanged

for Argentine currency or

used to buy goods.

Romero, of the

opposition Peronist Party, and officials of other

provinces claim their bonds are not really

new currencies because they

are no good outside their provinces.

JCT: Note once

again that not only did inflation not go up with

the injection of more local currency but,

contrary to orthodox

economic laws, inflation went down from

1,000% a year to about 36% a

year. This should be repeated as local

currencies break sacred

economic laws.

"The Argentinian

Provincial Government LETS 1/s local bond

currencies being added to circulation

made inflation of the federal

currency go down. To understand how reducing

foreclosures with more

money makes inflation go down, you have

to grasp the difference

between inflationary Shift A and Shift

B detailed in my LETS

Engineering Mathematics Analysis.

In conclusion,

Flaherty assumes that the whole extra 100% money

will come into circulation unbacked. Yet,

how would the money get into

circulation if no one earned it? As long

as every dollar the

government spends is issued in exchange

for goods and services value,

that currency is backed up by that value

received and there can't be

inflation. Think of those government spendings

as tax-credit receipts

for value. Like a good casino cashier,

chips can't be issued until

delivery of work. There can be no inflation

and no one knows how great

a production we might achieve upon which

to base even more money

issued into circulation without any inflation.

* Of course, Jaikaran

is not an economist; he is a plastic

*surgeon. Nor is he much of an historian.

Somehow he expects his

*plan would not be hyper-inflationary,

even though it was tried once

*before in American history.

JCT: It was tried

many times before in American history. And

there is a great difference between adding

chips to circulation in

exchange for equivalent value at the cage

and just dumping enough to

double the chip supply onto the casino

floor. And I just can't imagine

how that could be done and I've never

had any economist explain how

their theoretical "assume the money supply

doubles" is actually

effected. How can there be such a large

injection of currency without

some work being done?

*The Continental Congress, which organized

the principal army which

*fought the American Revolutionary War,

did not have any taxing or

*borrowing authority of its own and thus

had to rely on the meager

*contributions given to it by the newly

independent States. But from

*1775 to 1780 it also printed $250 million

in debt-free currency and

*spent it directly into existence.

This increase was well out of

*proportion to any growth in output and

hence caused some of the

*worst inflation in U.S. history. Jaikaran

is well aware of this

*inflationary episode because he discusses

it in Debt Virus.

JCT: There's

a difference between issuing chips in exchange for

roads, buildings, services and issuing

currency in exchange for bombs

that will blow up. What is not mentioned

is the sabotage of the

American Continental currency by British

counterfeiting but with all

payments going against the principal of

the national debt, I am sure

America could have finally honored even

$250 million over the next 50

or 100 years. And what is not mentioned

is the successful use of

interest-free currency by individual pre-revolution

States which

Benjamin Franklin credited for their prosperity

and the banning of

colonial scrip and imposed use of interest-bearing

gold which Ben

credited with causing the American Revolution

over the beggars in the

streets, not the tax on tea.

*But he does not address why his plan

would somehow not be

*inflationary even though it is identical

to the Continental Congress

*fiasco.

JCT: I do address

why government spending in exchange for value

is not inflationary. A LETS government

would not just spend money into

circulation to compensate for the imbalance

in prices but would

prevent the imbalance at the source. If

every token issued is backed

up one-for-one with collateral value,

there can be no inflation.

*Grassroots organizations cite it as inspiration

for various reform

*efforts. The Coalition to Reform Money

is a thorough believer in the

*debt-money myth and proposes what it

calls the "Monetary Reform Act"

*with provisions very similar to those

of Jaikaran's plan.

*The Coalition proposes the "Monetary

Reform Act" which would have the

*U.S. Treasury print currency and spend

it to meet all federal

*expenditures. Eventually, this would

eliminate the need for any

*federal taxation. Sovereignty recommends

only a one-time policy of

*additional federal spending financed

by newly printed Treasury money.

JCT: If they

won't install LETS, then government issuing "debt-

free" money is the next best thing. What's

saddest is that Sovereignty

has a database of over 3,000 municipalities

who have signed their

petition for interest-free funds and they

haven't thought of using a

LETS to do it themselves.

* There is no

danger of the Debt Virus thesis becoming an

*accepted idea in Congress, and certainly

not among economists, but

*this has not limited its adverse effects.

JCT: Sad truth

about a valid thesis.

*It has clearly lead many people to an

erroneous interpretation of the

*workings of the financial system and

has caused them to direct their

*political activist energies toward an

imaginary problem.

JCT: And now

that we've seen that the Debt Virus thesis has not

been successfully challenged by a claim

of Bank Expenses paid with new

deposits out of the tap, we can only be

glad that it has led many

people to a correct interpretation of

the workings of the financial

system and has caused them to direct their

energies toward the real

problem, if with an old-fashioned sub-optimal

solution. But a solution

that even my grandfather, that great Socred

Adelard Turmel, accepted

as valid.

Adelard's Axiom

#1: Money has no babies.

Adelard's Axiom

#2: Interest is theft

*into political awareness who might otherwise

be inert. But instead of

*directing their efforts toward real social,

economic, and political

*problems, they tilt windmills. What a

waste.

JCT: No, they

tilt at sound engineering design. What good news.

*URL to open: http://garnet.acns.fsu.edu/~eflahert/virus1.html

*Part One: The Debt Virus Hypothesis

*(last updated July 14, 1996)

*The Debt Virus Hypothesis:

*The imbalance between the debt level

and the size of the money supply

*is the source of financial instability.

The instability manifests

*itself in three ways:

*1. Rising Prices

*Because interest is another type of expense

in the production

*process for a firm, the ever-increasing

level of debt and its

*corresponding interest obligation increases

the cost of

*production which forces retail prices

higher. This forms a

*growing wedge between resource prices

and retail prices and

*is the reason the price level rises continuously

over time.

JCT: This is

the wedge of imbalance between money and prices

which I also identify with the mortgage

contract promising 11 for 10.

*2. A Slow Growth Economy

*The financial system generates interest

rates that are much

*higher than they would be under what

the Coalition calls a

*"wealth-based" monetary system.

JCT: Like many

old Social Crediters, they think we'll still

choose to allow a little 1/(s+i) in Earth's

future banking software.

They have not seen the simplicity of the

1/s system. The fact they

still permit positive feedback is testament

to their failure to fully

appreciate the repercussions of usury.

*this causes the unemployment rate to

be much higher than it could

*be and the growth rate of the economy

much slower than it would be.

JCT: LETS has

a zero "involuntary unemployment" rate.

*3. Bankruptcies

*IV: Solutions and Proposals

*The solution to the economy's catch-22

is a fundamental change in the

*order of the financial system. The Coalition

To Reform Money believes

*we must switch our money supply from

a debt-based currency to a

*wealth-based currency. "Wealth-based"

money is money that is spent

*into existence rather than borrowed into

existence.

JCT: I accept

that this was King Henry I's Tally solution. But

I've explained how there's nothing wrong

with a debt-based currency

though I have no objection to calling

money spent in exchange for

value a "wealth-based" money. The point

is the solution is not to

switch from debt- to wealth-base but to

eliminate the interest

feedback on either.

*In the nineteenth century, the Coalition

reminds us, the Treasury,

*under various free-coinage acts, would

mint for free gold and silver

*coins for anyone who brought them sufficient

amounts of the metals.

*This money was produced from the wealth

of the population rather

*than being created by having someone

take a loan.

JCT: Hoping to

count the wealth of the population in terms of

even more bullion produced certainly makes

the point that more money

is needed in the numerator to balance

the debt of the denominator.

*1. Create New Debt-Free Money

*Rather than have new money borrowed into

existence through

*the current Fed-Treasury arrangement,

money should be spent

*directly into existence by permitting

the Treasury either to

*print and to spend its own currency,

or to instruct the

*Federal Reserve to give the Treasury

free of charge the

*appropriate credit in its checking account

at the Fed. The

*new currency would eventually replace

Federal Reserve Notes

*which are our present currency. For a

historical example,

*Sovereignty cites United States Notes

which were printed and

*spent by the Treasury itself at various

points in U.S.

*history. Current law restricts the volume

of U.S. Notes to

*$300 million or less (31 US Code [3]''5115,

5119). The

*Treasury estimates that most of existing

U.S. Notes are in

*the hands of collectors.

JCT: Appropriate

credit means appropriate loans. Restricting it

to $300 million when it could be the whole

supply is their problem.

*Switching to this form of money would

end the periodic waves

*of bankruptcies, stem the rising tide

of debt, and reduce the

*gap between resource prices and retail

prices because

*interest costs would be substantially

lower.

JCT: Those are

the results that I would predict whether ShiftB is

fought by Socreds adding money to balance

their debts or by LETSers

eliminating the imbalance between Greendollars

and debts in the first

place.

*2. Spend the New Money on Capital Projects

*3. Eliminate Fractional Reserve Banking

*To prevent banks from creating additional

debt-money,

*Sovereignty proposes that all banks be

required to maintain

*100 percent reserves against deposits,

that is, an end to

*fractional reserve banking.

JCT: Unnecessary.

LETS is a zero fractional reserve system. So

may banks be. Reserves are immaterial.

Deposits of old money have

nothing to do with future issuance of

currency in a LETS, only

production offered to the cashier at the

cage. I have no problem with

banks running LETS and earning service

charges for their valuable

convenience. It's only the interest they

once used to charge that made

them offensive to me.

*This would leave the government as the

sole supplier of money for the

*economy. This idea is not unique to Sovereignty.

JCT: I don't

disagree that government as the sole supplier could

be done right but since it scares many

people who would rather have a

local currency under their own control,

I suggest a government account

be no different from a citizen's account.

The plus of central

government not doing it all themselves

when each municipality can do

much for themselves is that many municipalities

will simply

controlling finances themselves and that

can be accommodated. Yet,

it's just as easy to allow the banks to

also run LETS creating

Greendollars as easily as they create

federal dollars to satisfy

demand.

*Economist Irving Fisher advocated 100

percent reserve banking as

*early as 1910, and some monetary economists

today also advocate this,

*although for different reasons.

JCT: Missing

the whole point that reserves, whether 100% or 0%

are not the problem. The positive feedback

of interest is.

*The Coalition, Sovereignty, and the authors

of the books earlier

*mentioned claim a variety of benefits

that would follow the adoption

*of their proposals: a sharp reduction

in the level of debt in the

*economy, lower taxes, full employment,

a faster growing economy,

*price stability, and a reduction in welfare

expenditures. In other

*words it would bring economic utopia.

JCT: That is

also the Guarantee of the John The LETS Engineer.

*The desire of these groups to improve

the performance of the U.S.

*economy is certainly admirable. However,

their proposals are based on

*what they call a mathematical certainty:

that the financial system is

*substantially short of money. Far from

being a certainty, this idea

*is a serious fallacy. In the essay that

follows, I provide a detailed

*criticism of the Debt Virus hypothesis.

JCT: Well, Ed's

solution to the imbalance happened to be exactly

what the Socreds had been demanding, a

new injection from the tap to

balance the growth in debt due to interest.

Yet, now we know that Ed's

solution is not taking place and that

we face the same problems Ed has

failed to address.

Unfortunately,

many old Social Crediters get angry when they hear

that they're not going to get a chance

to balance the equation in the

numerator with their dividends, compensated

discounts and government

spending if John The Engineer balances

the equation in the denominator

first.

*Exposing the Debt Virus Fallacy.

*Part Two: A Critical Examination

*(last updated July 18, 1997)

*Counterpoint #1:

*The System is Not Short of Money

Considered above.

*Banks are not the only means to borrow

money. When a firm or a

*government issues a bond, it is essentially

trading its IOU for the

*public's demand deposit; no new money

is created, unlike when a bank

*extends credit. When the principal and

interest of a bond are repaid,

*no money is destroyed, unlike when a

bank loan is repaid.

JCT: The Debt

Virus still applies to an island of industries who

all sell 10% bonds and when the time to

pay the principal and the

interest, they find that they only have

the original principal they

were lent and can't pay the extra 10%

to get their bonds back.

*When money is used in a transaction to

retire one bond issue, the

*money is immediately available for other

transactions since it still

*exists within the economy.

JCT: And the

money is still immediately available for other loan

transactions even though it only exists

within the bank's potential

tap allowance.

*Therefore, a given supply of money can

be used to

*repay any balance of outstanding bonds

without having an effect on

the

*level of the money supply.

JCT: I don't

see how a given supply of principal can be used to

repay a balance of principal plus interest

loan on outstanding bonds.

*The exception to this is bonds held by

the banking system. A bond

*held by a bank is functionally the same

as a loan in terms of its

*effects on the money supply. When a bank

purchases a bond, money is

*created; and when a bank sells a bond,

money is destroyed.

JCT: Sure. Just

like a casino cashier allowed to accept bonds as

collateral for chips at the cage. When

our bank "purchases" a bond,

new chips are exchanged. When our bank

"sells" a bond, chips are

returned to the chip cage.

*The exceptions are when banks trade bonds

with each other or with the

*Federal Reserve. If the former is the

case, then there is no change

*in the money supply at all. If the banks

buy bonds from the Fed, then

*the monetary base decreases. If they

sell bonds to the Fed, then the

*monetary base increases.

JCT: The FED

cage issues chips if banks sell bonds and takes back

chips if the banks buy bonds back. Just

like all FED operations.

*Commercial banks are permitted by law

to hold only federal,

*state, or local government bonds; they

may not own any corporate

*bonds for their own accounts. Therefore,

if we wish to examine the

*economy's ability to pay off its outstanding

debts, then the correct

*measure of debt should include bank loans

plus bonds held by the

*banking system that is, total bank credit.

The repayment of these

*types of debt destroys money. All other

bonds must be excluded from

*the debt measure. The correct measure

of debt is presented below,

*along with the current level of the money

supply.

JCT: I think

I've shown that the Debt Virus can infect trade

using new or old money.

*Table 4 shows that if all bank loans

suddenly came due, and if all

*government bonds held by banks were retired,

then there is more than

*enough money in the U.S. economy to repay

the principal and interest

*due on both the loans and the bonds.

JCT: On the possibility

that much money has chosen to reside on

American soil, is there more than enough

money in the world economy to

repay the principal and the interest due

on both loans and bonds?

*This observation is also contrary to

the Debt Virus hypothesis.

*Including corporate and government bond

issues as part of the debt

*measure is erroneous because repaying

those loans does not cause the

*money supply to decrease. The same deposits

could be used any number

*of times to extinguish all bond liabilities

while leaving the money

*supply unaffected.

JCT: Must be

not. If the FED creates new money to buy government

bonds, it destroys new money when it sells

them. So if the government

takes out loans creating new money, it

repays loans destroying money

and causing the money supply to decrease.

The FED as well as the banks

do have connections to the sink.

*Counterpoint #4:

*Federal Reserve Earnings Go To the Treasury

*The Debt Virus explanation for how Federal

Reserve Notes enter the

*economy is correct, but it neglects two

very important points. First,

*like a commercial bank, the Federal Reserve

system has expenses which

*are met by spending the interest income

it collects from the

*Treasury.

JCT: Repeating

that bank expenses are met out of the reservoir

and do not come from the tap.

*Second, nearly all of its remaining earnings

above its operating

*costs are paid to the Treasury. It then

spends this money as part of

*its general revenues.

JCT: Positive

then negative feedback to prove it doesn't matter.

So why have the middleman at all?

*In 1994 the Federal Reserve paid more

to the Treasury than the

*Treasury paid to the Fed in interest.

This is typical for all years.

*In effect, the Treasury securities held

by the Fed are interest-free

*loans to the federal government.

JCT: So in effect,

if they're interest-free loans to the

government, then why not just give interest-free

loans to the

government? Why the two motions of taking

and giving back.

*Federal Reserve Notes therefore do

*not carry a net interest obligation.

The Treasury can then use this

*money to spend on Congressionally appropriated

items free of any net

*cost. This is exactly what the Coalition

and Sovereignty groups want,

*except that they would have the Treasury

print and spend the money

*directly rather than through indirect

process via the Fed (more on

*this later).

JCT: Except that

is a big difference. They don't want a cut of

the already existing interest revenues,

they want new deposits. They

don't want the interest splashing from

government to Fed back to

government in the pool, they want new

funds from the pumphouse.

*Counterpoint #5:

*Interest Does Not Cause Higher Prices

*It is difficult to discern the relationship

between interest costs

*and retail prices among the various Debt

Virus advocates. On some

*occasions they assert that interest causes

higher prices.

JCT: I do. Prices

= Debt = P+I minimum.

*In other cases, they claim interest causes

higher inflation.

JCT: In my case,

Inflation J is a direct function of interest

rate i. J(i).

*These are two very different conjectures.

Let me first examine the

*supposed link between interest and the

price level.

*In the Debt Virus model, interest is

a cost of production and is

*therefore passed along to the consumer

in the form of higher price

*This is wrong for several reasons. First,

in the short-run interest

*expense is a fixed cost of production

in that it does not vary with

*the level of output.

JCT: It is still

a component of the price.

*Even if a change in interest rates makes

a substantial difference in

*price in the long-run, prices for some

goods will be affected more

*than others. This is not price inflation;

it is a change in the

*relative prices of goods.

JCT: Yes, when

interest rates make a substantial difference in

prices in the long-run, regardless that

prices for some goods will

differ from others, this is price inflation,

a change in the relative

prices of goods, all due to interest.

*Inflation is a continuous rise in the

average level of all

*prices in the economy, not just a group

of prices.

JCT: And interest

is a component of every business's budget.

Raise interest and the only way pay the

banker is to raise your

prices.

*Only an increase in the supply of money

relative to the amount of

*goods for sale can cause sustained price

inflation.

JCT: An admission

that he has never even contemplated the

possibility of ShiftB inflation. It must

be ShiftA, too much money.

*The hypothesized link between interest

and the price level can be

*tested empirically. If interest costs

form a wedge between resource

*prices and retail prices, then higher

interest rates ought to make

*the wedge bigger and increase retail

prices. That is, an increase in

*interest rates ought to increase the

price level. Conversely, a

*decrease in interest rates should lower

the price level -- as the

*wedge gets smaller competition between

firms will bid prices down.

JCT: Yes, prices

(Principal+Interest) are a direct function of

the interest rate. No, they won't be bidding

the prices down when

their interest costs are reduced, they

will be decreasing them

pursuant to the savings in their bank

statement. When interest is

zero, all costs are spent for earthly

goods and services with no

component of the price in phantom debt

service and no inflation is

possible.

*The Coalition and Sovereignty groups

also postulate a strong positive

*correlation between interest rates and

inflation. On this economists

*can agree. However, there are two problems.

First, a link between

*interest rates and inflation does not

logically fall out of the Debt

*Virus hypothesis.

JCT: It does

out of mine. Over 1 cycle, minimum expected

inflation is I/(P+I), a direct function

of the interest rate. J(i).

*In their model, an increase in interest

rates will push up costs and

*retail prices. This is a one-time increase

in the price level.

*Inflation is the rate of change in the

price level over time.

JCT: Ed wants

to say inflation is a rate of change, I want to say

inflation is an instantaneous change right

after the bank informs you

you have to come up with more to survive.

*To quote Makinen and Woodward, "Sovereignty

adherents are off by

*one derivative" (Makinen, 1994).

JCT: Or Makinen

and Woodward are off by one derivative.

*For the Debt Virus hypothesis to be correct,

a single increase in

*interest rates would have to cause a

continual and proportional

*increase in the price level, and there

is nothing in the hypothesis

*which permits such an effect.

JCT: The increase

in interest rate expense does cause a continual

and proportional increase in the price

level.

*Second, their arrow of causality points

the wrong direction: interest

*rates do not cause inflation; inflation

causes interest rates.

JCT: He's saying

that interest I is a function of the inflation

rate j. I(j) One of certainly has their

arrow of causality pointed in

the wrong direction. Interest rates do

cause inflation, J(i), and

inflation does not cause interest rates.

Bank governors do.

*Economists agree there is a strong link

between interest rates and

*inflation, but that it is inflation that

causes interest rates.

JCT: Inflation

is something they measure. Interest is something

they set. Interest is not a direct function

of the inflation rate Just

because bank governors choose to set interest

to follow inflation

doesn't make interest a natural function

of inflation.

*Financial markets and creditors build

their expectations about future

*inflation into the current interest rate

they charge to protect the

*purchasing power of the principal they

lend.

JCT: That's right.

Bank governors build the rate with their false

expectations. It's not a naturally occurring

statistic.

*Moreover, the idea that changes in inflation

cause changes in

*interest rates is supported by

strong empirical evidence.

JCT: He's noticed

that every time inflation went up, the FED

chairman raised the rate and sees it as

empirical evidence of interest

being a natural direct function of the

inflation rate.

*Counterpoint #6:

*Contradictions in Sovereignty Arguments

*Second, in a promotional video a Sovereignty

advocate, Mr. Edward

*Mrkvicka, states that Treasury money,

"if phased in correctly, is not

*inflationary any more than any added

dollar to the money supply is

*inflationary." This appears to be an

admission that their proposal

*has inflationary consequences which again

contradicts the basic Debt

*Virus hypothesis that Treasury money

would be less inflationary than

*Federal Reserve Notes.

JCT: I take it

as an admission that over-issuance had ShiftA

inflationary consequence, not that "correctly-phased-in"

issuance

would too.

*Fundamentally, all Sovereignty proponents

want is a faster money

*supply growth rate than what the Fed

considers to be adequate.

JCT: Evidently,

this is not all.

*Evaluating the Coalition and Sovereignty

Proposals

*1. Issue New Debt-Free Money

*Even the U.S. Notes which Sovereignty

uses as a historical example

*of their recommendation are classified

as part of the non-interest

*bearing portion of the national debt

(31 US Code [10]'5119). It is

*true that additional money of this type

would increase the

*national debt without increasing interest

payments for the federal

*government, but this is already the current

situation with new

*issues of Federal Reserve Notes.

JCT: So why not

make it the same thing for the credit received?

*The key difference between the current

arrangement and the one

*advocated by Sovereignty and the Coalition

is that issues of

*currency are now controlled by a mostly

non-political body, the

*Board of Governors of the Federal Reserve

system, whereas under

*their scenario it would be controlled

by purely political bodies,

*Congress and/or the executive branch.

JCT: A agree

100%. Decisions on a nation's monetary policies

should be made by elected officials, not

profit-oriented businessmen.

*Several economists have examined the

relationship between central

*bank political independence and inflation.

(See for example Wyss and

*Blondia (1988) and Grier (1987) ). For

the major industrialized

*countries the studies have found that

economies with a central bank

*tied relatively closely to the political

process, such as in Great

*Britain and Italy, had higher average

annual inflation rates

*during the 1955-1990 period than those

economies with more

*independent central banks, such as Germany

and the United States.

*I do not think this is a coincidence.

And inflation

is something generated by governors who set the

interest rates. They have the power to

control those results.

*Second, such large regular increases

in the money supply would be

*very inflationary.

JCT: As pointed

out, not if backed up by production.

*Few ideas in economics have been demonstrated

so well by governments

*throughout history: when the money supply

rises faster than the

*growth of real output of goods, inflation

must be the result.

JCT: Finally,

he admits a link he's never mentioned before

between money and output of goods. The

whole point of Sovereignty's

proposal is to spend it all on the output

of new goods to match the

new currency issued into circulation in

payment of those new goods.

*The U.S. is no exception to this rule

(See

*Friedman and Schwartz, A Monetary History

of the United States,

*for a thorough treatment). The higher

rates of inflation would

*then increase, not decrease, interest

rates via the Fisher Effect.

JCT: I guess

Fisher's another who didn't notice that interest

rates are not measured as a function of

the inflation rate, they are

set as a function of the inflation rate.

A big difference.

*Their proposal is essentially expansionary

fiscal policy combined

*with monetary accommodation by the Federal

Reserve, that is,

*combined with expansionary monetary policy.

If the Fed were to

*commit to purchasing an amount of securities

equal to the amount

*of additional federal spending, then

the effect would be identical

*to the Treasury printing the $360 billion

needed and spending into

*the economy.

JCT: Except that

under the Sovereignty proposal, the tax to be

levied necessary to redeem the loans would

be for $360 billion and not

for double or triple with interest over

the next decades. Sure the

injection of money would be the same but

the replacement of that money

would be radically different with radically

different repercussions.

*Such arrangements between the Treasury

and the

*Federal Reserve have taken place several

times in the past, always

*with inflationary consequences. How inflationary

this proposal

*would actually become would depend on

whether the spending took

*place in a recession, when there is plenty

of slack in the economy

*and it can handle increased production

without much inflation, or

*whether it was done near full employment.

If the latter is the

*case, then there would be no appreciable

increase in real output

*with the entire effect of the plan being

inflationary. This would

*hold true whether the $360 billion were

literally printed by the

*Treasury, or whether the Fed provided

monetary accommodation. This

*increased inflation would boost interest

rates in accordance with

*the Fisher Effect, and this would actually

increase the Treasury's

*interest burden, not decrease it.

JCT: If the government

couldn't hire anybody with their $360

billion because everyone was already employed,

how does the $360

billion get into circulation to effect

inflation? Mail everyone some?

*3. Eliminate Fractional Reserve Banking

*Their ability to create checkbook money

via the deposit expansion

*process would be eliminated.

JCT: I

don't care about their deposit creation, only their

interest charges on those deposits.

*The need for credit is extensive in a

capitalist economy. No

*government can prevent two parties from

agreeing to an exchange of

*credit. Nor can government prevent the

private sector from accepting

*paper representations of such transactions

as money. This is what

*the deposit expansion process does: it

creates a new IOU, a checking

*account credit, which the private sector

chooses voluntarily to

*use as a means of exchange.

JCT: Exactly

what LETS does. Multi-parties agree to an exchange

of credit accepting paper representations

of such transactions as

Greendollars. This is what the LETS deposit

expansion does: it creates

a new IOU, a LETS checking account credit,

which the private sector

chooses voluntarily to use as a medium

of exchange.

*Other Problems

*In many instances he injects his own

subjective values into

*his analysis, such as when he describes

profits as immoral and

*interest as usury. A scientist must be

an objective, dispassionate

*observer of his subject. Personal values

have no place in scientific

*analysis.

JCT: I consider

interest the mechanism of debt slavery the

planet's inhabitants find themselves chained

in. I consider profits

quite moral and interest on money, not

cows, as usury when it inflicts

a death-gamble upon its participants.

As an objective,

passionate observer on my subject, this banking

systems engineer is appalled by the death

and destruction caused by

this errant financial software and my

passion for its upgrading to

LETS does not detract from the integrity

of the engineering analysis

upon which those emotions are based. It's

not for nothing that the

mort-gage "death-gamble" is so roundly

condemned by most of the

world's better religions.

*Self-contradictions and non sequiturs

abound.

JCT: Seems the

self-contradictions and non sequiturs are

abounding in Ed's analysis, I've seen

little other than the allowance

for a little interest positive feedback

that I find objectionable.

*Conclusion

*The Debt Virus hypothesis is wrong. Its

error is due to its failure

*to recognize how banks interact in the

economy.

JCT: It's veracity

is due to recognizing how the economy

interacts with the bank's pump and reservoir.

*The error was here shown with a detailed

T-account analysis of this

*interaction and was demonstrated with

two simple empirical tests of

*the predictions and implications of the

hypothesis. The first test

*examined the prediction that deposits

can grow only as much as new

*bank credit plus new currency emissions.

Data for six recent months

*showed that the deposits in the banking

system grew considerably more

*than what can be accounted for by additional

bank credit and new

*currency -- an unmistakable contradiction

of the Debt Virus

*hypothesis. The second trial examined

the prediction that the price

*level and interest rates are positively

correlated. To test this

*claim, I collected price level and interest

rate data from 1970 to

*1995 and calculated a simple correlation

coefficient. The statistical

*and graphical results demonstrated that

no such correlation exists.

*The Debt Virus hypothesis failed this

test as well. Combined with

*flaws in logic, a fundamental misunderstanding

of how the financial

*system actually works, and several contradictions

in its body of

*thought, the Debt Virus hypothesis must

be rejected. Consequently,

*the recommendations of Jaikaran, the

Coalition to Reform Money, and

*Sovereignty are based on fallacious arguments

and should also be

*rejected.

So, Ed is wrong

when he says that:

1) the imbalance raised by the Debt Virus

thesis is compensated for by

new deposits created to pay for Bank Expenses,

etc.

2) interest does not cause higher prices.

3) interest does not cause inflation.

4) inflation causes interest when interest

is set by humans.

5) government spending is unbacked and

would cause inflation.

6) more money causes inflation ShiftA

when it fights ShiftB.

7) the FED's giving Treasury back the

interest makes it interest-free.

8) monetary matters should best be left

to private bankers.

9) calling interest on money usury is

too subjective.

10) Debt Virus solution won't work when

it easily could.

I decided I was

going to try to settle the contradictory piping

and posted a message to Ed:

TURMEL: Flaherty's Contradiction

Article #393 (394 is last):

From: eflahert@garnet1.acns.fsu.edu (Edward

Flaherty)

Newsgroups: alt.fan.john-turmel,can.politics,ncf.ca.lets,own.eco.lets,sci.econ,sci.engr,alt.conspiracy

Subject: TURMEL: Flaherty's Contradiction?

Date: Mon Nov 09 23:56:33 1997

Ed:

In your Debt

Virus text, you say:

* Banks are no

different in the real world. Commercial banks

*and savings and loans have expenses to

pay just like any other

*firm. They must pay their employees,

purchase office supplies, and

*meet the other expenditures which are

a part of doing business.

*When they do this banks spend money back

into the economy without

*any debt being created to burden the

non-bank public -- debt-free

*money as it were. The revenues

banks collect from interest on

*loans and other services do not disappear

into an economic void.

*Instead, those revenues are used to meet

the bank's operating

*expenses, to purchase assets to generate

future income, or are paid

*to the shareholders as dividends.

JCT: You may

note that this fits in with my plumbing model of the

banking system:

Fig. 3

FRACTIONAL RESERVE BANK

Fig. 3 is the

interior plumbing of a chartered bank which shows

that the revenues banks collect through

the Interest(in) pipe from

loans and other services are used to meet

the bank's operating

expenses, to purchase assets to generate

future income, or are paid

to the shareholders as dividends through

the Bank Expenses pipe. And

it is true that these funds go back to

the economy free of debt though

I call it splashing in the pool.

*In Dr. Jaikaran's model, the only interaction

a bank has with the

*economy is to extend a loan and to collect

on it.

JCT: More precisely,

the plumbing shows that the only interaction

a bank has with the economy through the

tap of new money in the

pumphouse is to extend a loan and collect

the principal payments on

it. Yet:

*In the real world banks must pay their

employees, pay interest

*to their depositors, meet their other

expenses, and purchase

*equipment. When the banking system does

this, it spends into existence

*new "debt-free" money (debt-free in the

sense that no one outside the

*banking system is required to obtain

a new loan). In other words, the

*system creates a new demand deposit out

of nothing, adding to the

*money supply without the creation of

any additional bank credit (loans

*plus bank-held bonds) being necessary.

JCT: This says

that the Bank Expenses tube is connected to a tap.

Fig 3b

FRACTIONAL RESERVE BANK

*Summarizing the first counterpoint, the

banking system creates new

*"debt-free" money in the form of new

deposits whenever it pays its

*expenses or purchases fixed assets. These

deposits do not represent

*loan principal or interest which the

non-bank public must eventually

*repay. Contrary to the Debt Virus thesis,

new bank credit is not the

*only source of new money.

JCT: Your contention

that the Bank Expenses pipe is

connected to the tap is contradicted by

your statements that it's

connected to the reservoir of bank revenues.

I believe that only the

Loans(out) pipe is connected to tap of

new money and Bank Expenses are

as you yourself say: "banks spend money

back into the economy.." The

money spent back into the economy is the

money first taken out before

being put back.

*Counterpoint #4:

*Federal Reserve Earnings Go To the Treasury

*The Debt Virus explanation for how Federal

Reserve Notes enter the

*economy is correct, but it neglects two

very important points. First,

*like a commercial bank, the Federal Reserve

system has expenses which

*are met by spending the interest income

it collects from the Treasury.

JCT: Same contradiction.

The FED can't be paying for expenses

with already-existing revenues from the

reservoir and with newly-

created money in the pumphouse at the

same time.

So, Ed, before

I continue parsing your words for my Nov 12

presentation at Rensselaer Polytechnical

Institute, I'd like you to

indicate what the Bank Expenses Out pipe

is connected to, the

reservoir of revenues as in Fig 3 or the

tap of new money as in Fig

3b?

--

*Article #394 (394 is last):

*From: eflahert@garnet1.acns.fsu.edu (Edward

Flaherty)

*Newsgroups: can.politics,ncf.ca.lets,own.eco.lets,

*alt.fan.john-turmel,sci.econ,sci.engr,alt.conspiracy

*Subject: Re: TURMEL: Flaherty's Contradiction?

*Date: Mon Nov 10 11:56:33 1997

*bc726@FreeNet.Carleton.CA (John Turmel)

writes:

** JCT: Your contention

that the Bank Expenses pipe is

**connected to the tap is contradicted

by your statements that it's

**connected to the reservoir of bank revenues.

I believe that only the

**Loans(out) pipe is connected to tap

of new money and Bank Expenses

**are as you yourself say: "banks spend

money back into the economy.."

**The money spent back into the economy

is the money first taken out

**before being put back.

*It's not really a contradiction, depending

on how you view the

*mechanics of money-creation. Consider

the following examples.

*A loan customer pays interest to the

bank by writing a check and

*sending it to the bank for payment.

The bank's balance sheet will

*change like this:

*Assets

Liabilities & Capital

*------------------------------------------------

*

| - deposits

*

| + capital

*So technically, by paying interest money

is destroyed.

JCT: No. Deposits

in the customer's reservoir account go down and

and deposits in the bank's reservoir capital

account go up. Money is

not destroyed down the drain by the payment

of interest.

*However, the bank can now create new

deposits, perhaps for expenses,

*dividend payment, buying assets, or another

loan. If the

*bank pays its employees who then deposit

the funds back into

*the bank, the balance sheet will change

thusly:

*

*Assets

Liabilities & Capital

*------------------------------------------------

*

| + deposits

*

| - capital

*So here, new money is created without

additional loans being created.

JCT: No. Money

goes from the bank's capital reservoir account to

the customer's deposit account. It's a

switch of deposits, splashing

in the pool.

*If we think of both transactions as one,

which is what I imply

*in the first paragraph you quoted, then

money is not really

*destroyed in this first step since it

will need to be created

*(or re-created as they case may be) to

fund expenses and what-not.

*If we detail the transactions separately,

then money is destroyed

*and then re-created.

JCT: Again, he's

suggesting that the pipes look like Fig 3c with

interest into the bank going to the drain

rather than the reservoir.

*So it's not really a contradiction, just

a lack of detail or

*clarity on my part.

JCT: Whether

the Interest(in) and Interest(out) pipes are

connected to the reservoir or to the Drain

and Tap is of consequence.

If the pipes go through the reservoir,

the money supply does not

change. If through the drain and then

the tap, the money supply dips

and then rises.

*I guess that depends on how detailed

you want the money-creation

*mechanics to be. If highly detailed,

then both.

JCT: The plumbing

diagrams are as highly detailed as possible and

they show two alternatives - three with

the recent claim that

Interest(in) goes to the drain. It can't

be both. Either the Bank

Expenses come from the reservoir or they

come from the tap.

*If less detailed, then Fig 3 would more

accurately represent my story.

JCT: Fig. 3 accurately

represents my story but only seems to half

represent yours. Since it really is Fig.

3, then no new money is

created in the payment of bank expenses

and the imbalance raised in

the Debt Virus Thesis has not been addressed.

*Edward Flaherty

*School of Business & Economics

*University of Charleston

JCT:

John C. Turmel, B. Eng.

Banking Systems Engineer.

Carleton University.